As you may know, there’s been a lot of changes under the Labour government. One of these is the change in stamp duty thresholds, which could impact the cost of your move in 2025. From the 1st April, the amount people pay for Stamp Duty Land Tax (SDLT) could cost thousands more which is why for movers, you may want to plan ahead.

At PM Property Lawyers, we want to save you money if we can. That’s why we are introducing our Completion Acceleration Offering, which is designed to accelerate your completion date, with the goal to finish the purchase of the property before April 1st. By doing this you might be able to pay less SDLT, saving you money during a time when every pound counts.

What is Stamp Duty Land Tax?

Stamp Duty Land Tax (SDLT) is a lump sum of money you pay to the government when you purchase a property or piece of land that is over a certain price. The amount you pay is dependent on the price of the house, if the property is freehold or leasehold, if you own more properties or if you’re a first-time buyer, and the thresholds that are set by the government. When the thresholds change, this can have a huge impact on the amount someone pays, sometimes costing thousands more.

If you want to see how much you would pay, and whether it would be more under the new thresholds, you can input the details into a stamp duty calculator.

How and Why is Stamp Duty Land Tax Changing?

There have been a few changes to SDLT in recent years due to the changes in government and economic goals. In September 2022, the Conservative government changed the amount the property has to be to pay SDLT, with the idea this would make buying housing more accessible.

However, when the Labour government came into power, they announced in their October budget that they were increasing the rates. These are set to change again from April 1st 2025, meaning people might have to pay a lot more if their completion day is on April 1st 2025, rather than March 31st.

Again, this is dependent on a few factors, such as whether you’re a first-time buyer, replacing a main residence, if you’re purchasing additional property, or whether you’re purchasing the property as a company or an individual. There may be more to consider than this, but for the sake of simplicity, we’ll focus on some examples.

If you do have any specific questions, contact one of our team and we’ll see how we can help.

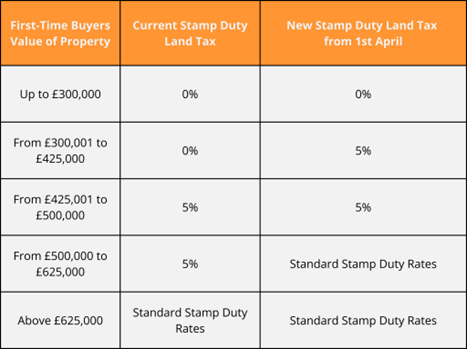

First-time Buyers Stamp Duty Land Tax Rates From 1st April 2025

If you’re buying your first house, you are entitled to claim a first-time buyer’s discount on SDLT. But when the changes come into effect on April 1st 2025, this could make a big difference to the amount you have to pay.

For example, if you’re a first-time buyer who completes a sale on a house that’s £350,000 on the 31st March, you won’t pay any stamp duty. However if you buy the same house on the 1st April the bill will be £2,500. On top of everything else that first-time buyers have to pay for, this could come as a bit of a blow.

The changes for first-time buyers stamp duty land tax rates are as follows:

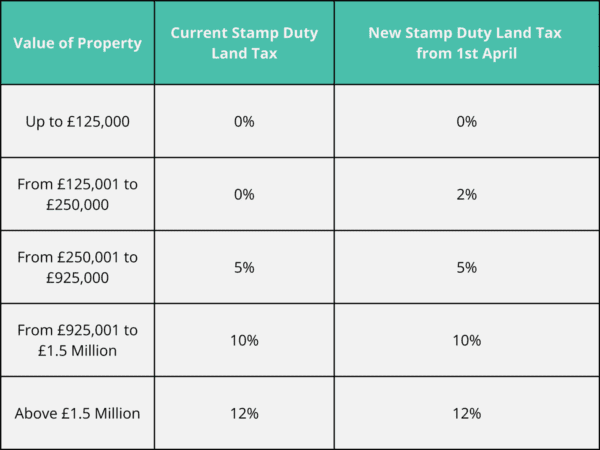

Stamp Duty Land Tax Rates From 1st April 2025

If you’re looking to replace your main residence with another one, the standard SDLT will apply. This could mean if you’re already on the property ladder there could be quite a drastic increase in the amount you have to pay, which isn’t ideal if you’re looking to save a bit of money.

For example, if you bought a house for £250,000 on 31st March, you wouldn’t pay any stamp duty. But if you bought the same house on 1st April, the bill will be £2,500.

The changes SDLT rates are as follows:

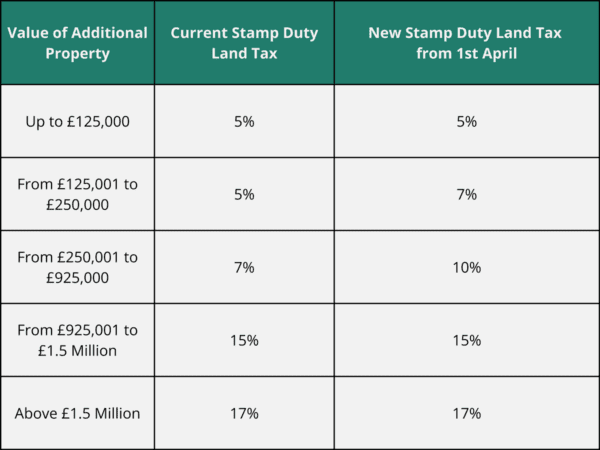

Stamp Duty Land Tax Rates on Second Homes from 1st April 2025

For people purchasing a second property, there are some minor changes to SDLT depending on the price of the house you purchase. Although these changes don’t appear as drastic, you could still save money if you decide to accelerate your completion date.

For example, if you bought a second home on the 31st March 2025, you would pay £15,000 in SDLT. However, if you bought the same property on the 1st April, you would pay £17,500. This is an extra expense and the money could be used elsewhere.

The changes to SDLT rates on second homes are as follows:

How We Can Help – Completion Acceleration

At PM Property Lawyers, we pride ourselves on offering an outstanding level of service to our customers. Which is why when there’s a change that might affect your property purchase, we respond. We understand that when you’re buying a property, unexpected expenses can hit you like a tonne of bricks. With our Completion Acceleration Offering, we will aim to accelerate your completion date which in order to reduce the likelihood that you will have to pay additional SDLT. Our offering costs £500 + £100 VAT (20%).

As there is a tight time frame, the deadline for this is 7th February 2025. Request a call back today, and speak to one of our experienced team members, and see if we can help you.

Requesting a callback does not guarantee that you will be accepted for Completion Acceleration. If our Property Lawyers do accelerate your case, this means your file will be prioritised, this does not guarantee that your purchase will complete before 1st April 2025, however we will work extremely hard to achieve this for you.