Having a passive income is one of the best ways to ensure that you have a steady cash flow alongside your full-time job. When you invest in property, tenants pay the mortgage, and you also make an additional income on top. It almost sounds too good to be true. But that’s the beauty of property investment.

For most people, when they consider buying a property to let, they think about buying a residential property for people to rent as their home. But there is another option with a different set of advantages, and that’s commercial property.

What is a Commercial Property?

A commercial property is any property that is designed for commercial use. In other words, they’re properties that are designed for businesses, rather than living in. There are many types of commercial property, these include:

- Offices

- Hospitality and leisure – restaurants, bars, cafes, hotels etc

- Retail – shops, shopping centres

- Industrial – Warehouses, factories

- Healthcare Facilities – Hospitals, medical centres, care homes

- Agricultural – Farms and farm land

Within these categories, each property will be put into classes under the Town and Country Planning (Uses Classes) Order of 1987. This will determine how the property can be used. It’s important that people understand the different classes, because if a property is being occupied in a way it’s not specified to be, the owner can be fined. Alternatively, if the way the property is being occupied was going to be changed, you would need to apply for planning permission.

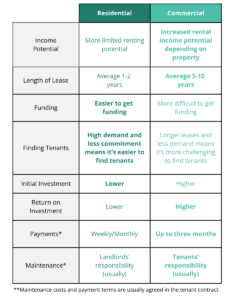

There’s always the option to invest in residential property, and understanding the key difference between the two can help you to explore your options.

Commercial Property Vs Residential Property

Like all investments, making sure you take all options and factors into consideration is the best place to start. There are many things to consider before buying commercial property, and making sure it’s the right financial decision for you, is one of the only ways to predict whether the benefits outweigh the potential drawbacks.

There are many benefits to owning a house and renting it to someone as their home. Renting out residential property is also easier to get into in terms of funding, and may be a better place to start your property investment journey. On top of that, it’s easier to find tenants, as no matter what the economy is like, people always need somewhere to live.

However, that doesn’t mean you shouldn’t consider buying commercial property, it’s just that you need to way up the pros and cons. Buying commercial property usually has a higher initial payment, but also tends to have a higher profit margin. So putting down more money in the beginning could offer a better return on investment in the long run.

The Advantages of Owning Commercial Property

Getting a well-rounded view of the advantages of owning commercial property can help give you an idea of the kind of property investment that suits your circumstances. Some of the main advantages include, but are not limited to:

Income Potential – Buying commercial property can be used to dramatically boost your income. As there is such a wide range of properties to choose from, you can select one that gives you the best opportunity to boost the income potential. For example, if you were to invest in a shopping centre, you would have the opportunity to rent to multiple businesses. Or if you bought a multi story office building, you could rent each floor to a different company. If you bought a house, other than the possibility of renting to multiple people in the form of a house share, your income potential is more limited.

Long term leases – Most businesses lease their premises for longer periods of time in comparison to residential tenants. Renting commercial property can mean the business rents it for 5-10 years, which gives you consistent income over that period of time, and reduces the risk of the property being left without a tenant as often. This gives you more financial stability for longer periods of time.

Payments – When you’re renting a living space, oftentimes the payments are monthly. However, when you’re renting commercial property, businesses may pay up to three months at a time, giving you a lump sum of money to play with quarterly. This however is subject to a variety of factors, like location and property type. Payment will be agreed in the tenant contract.

Maintenance – In most cases, the maintenance of a commercial property is down to the tenant, rather than the landlord. This stops surprise expenses that residential landlords may be unprepared for. Not having to consider maintenance of the building not only saves money, but also reduces stress. Much like payment, this is agreed in the tenant contract and can vary depending on things like location and property type.

Development Potential – As long as you select the right property when it comes to things like location, size, planning permission etc, there is a lot of opportunity to develop commercial property, thus having the ability to increase the value. This can come in the form of things like repurposing or renovations. Over time this can either increase the sales value, or perhaps the amount of rent someone pays. Although you still have this opportunity with residential properties, the options can be more limited.

Buying a commercial property not only diversifies investment portfolios, it can have a huge amount of benefits in terms of income, financial stability and more. We’ve gone over some of the potential advantages, but obviously there’s a lot more to explore in the realms of commercial property.

Giving you a general overview should get you started, but if you’re ready to take the leap, it’s time to get in touch with a specialised commercial conveyancer. At PM Property Lawyers, we can look after you from the beginning all the way up to the finishing of sale. Get a quote today and see how we can help you make the investment of a lifetime.